The global market for hydrogen fuel cells is expected to reach 5.9 billion USD by 2030, according to a recent report by DataM Intelligence.

The sector, which was valued at 3.64 billion USD in 2024, is projected to expand at a compound annual growth rate (CAGR) of 8.3% between 2024 and 2031, driven in part by the increasing adoption of zero-emission vehicles.

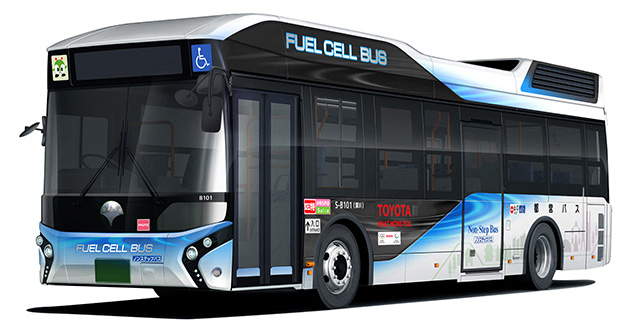

Hydrogen fuel cells generate electricity through the reaction of hydrogen with oxygen, producing only water as a by-product. This feature makes them particularly suitable for heavy-duty vehicles, including buses, which benefit from longer driving ranges and faster refuelling times compared with battery-electric alternatives.

Governments across the United States, Japan, South Korea, China, and the European Union have invested more than 200 billion USD in national hydrogen strategies, a significant portion of which supports the deployment of fuel-cell vehicles (FCEVs). In the United States alone, hydrogen hubs funded under the Infrastructure Law exceed 8 billion USD, supporting fleet electrification and station expansion.

The transportation segment is currently the largest user of hydrogen fuel cells, accounting for nearly 46% of market revenues in 2024. Fuel-cell buses are seeing increased adoption as cities look to decarbonise public transport. Bus operators are increasingly attracted to the technology because of the combination of longer operational range, shorter refuelling times, and reduced emissions, which support urban air quality and sustainability targets.

Other transportation applications include fuel-cell trucks, forklifts, and passenger cars. By 2030, heavy-duty transportation, including buses, is expected to account for more than half of new proton exchange membrane fuel cell (PEMFC) installations globally.

Outside of transport, stationary fuel cells are used for data centres, hospitals, and industrial facilities, representing around 40% of current market value. Solid oxide fuel cells (SOFC) and molten carbonate fuel cells (MCFC) are commonly deployed for distributed power generation and industrial heat applications. Portable fuel cells, used in defence, telecom, and emergency response, account for approximately 14% of the market.

Hydrogen fuel cells are expected to become a more common feature in city and regional bus fleets over the next decade. With the expansion of refuelling networks and reductions in green hydrogen costs projected between 40% and 60%, bus operators will have greater flexibility to deploy zero-emission vehicles without the limitations associated with battery charging times.

Industry analysts also anticipate that hydrogen-powered buses will increasingly complement battery-electric buses, particularly on longer routes or in areas where charging infrastructure is limited. Demonstration projects and pilot programmes in Europe, Japan, and the US indicate that commercial adoption could accelerate through the 2030s.